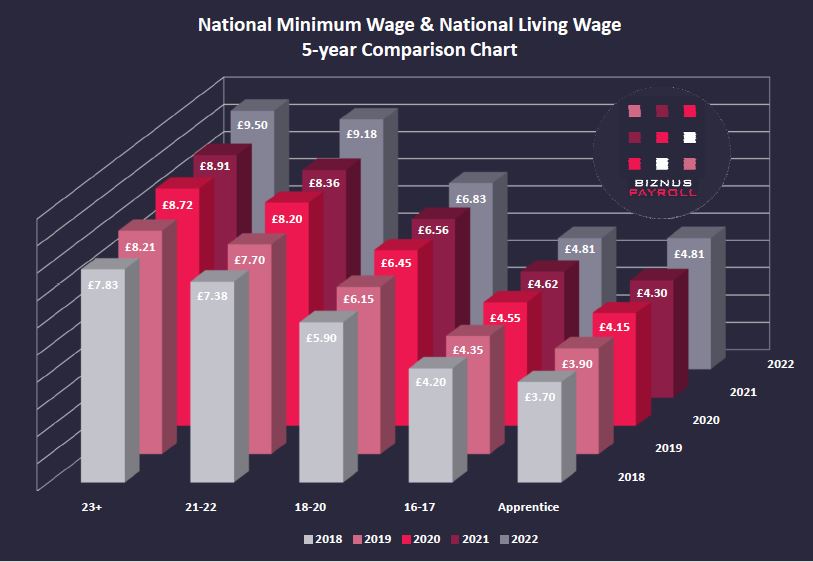

As of April 1st, there will be an increase to the minimum wage in the UK. The increases are across all age brackets from 16-23+, this also includes apprentices.

The Government has confirmed that:

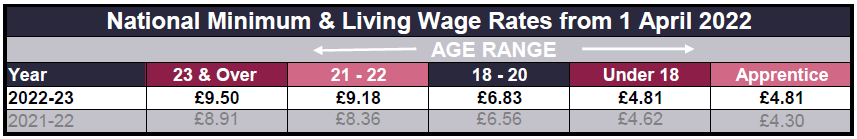

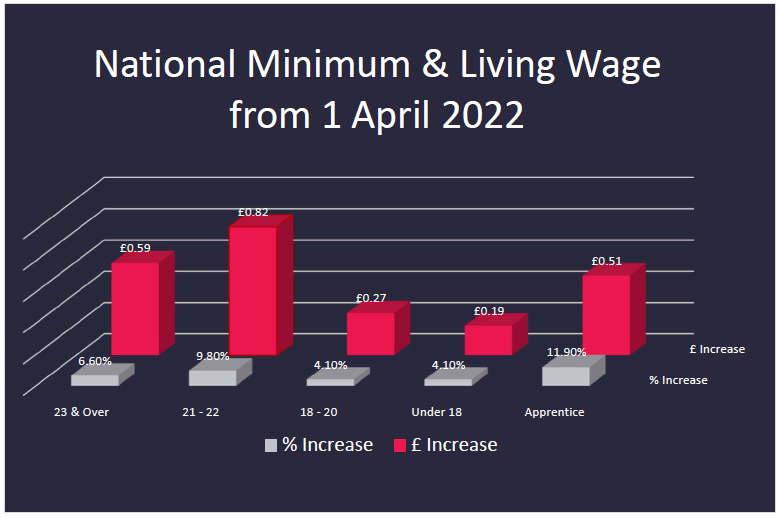

The National Living Wage (for over 23-year-olds) will increase by 6.6% from £8.91 to £9.50.

The National Minimum Wage will rise across all age groups

Those who fall in to the 21-22 age range will see the highest pay increase in 2022.

This increase comes as part of the Government’s target of a national living wage set at two-thirds of median earnings by 2024.

In October 2021, the Low Pay Commission (LPC) put forward the recommended hike in wages following new data on the UK’s recovering economy.

The LPC report also found that the lowering of the NLW age from 25 to 23 went smoothly and that it should be further reduced to 21 by 2024.